Medicare Tax Rate 2025 High Income

Medicare Tax Rate 2025 High Income - 2025 Tax Brackets And Deductions Jody Millisent, The budget proposes to increase the medicare tax rate on earned and unearned income. [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare. The rise in the cost of part d prescription drug plans will vary from state to state.

2025 Tax Brackets And Deductions Jody Millisent, The budget proposes to increase the medicare tax rate on earned and unearned income. [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare.

Once you determine your income for medicare levy surcharge (mls) purposes, you can use the mls income threshold tables.

Medicare Premiums 2025 High Margy Saundra, Let’s say a $75,000 annual salary might sound promising, after factoring in taxes (federal, state, social security, and medicare) at a conservative 35%, that number. For the 2025 tax year, those levels are:

Medicare Preventive Services Chart 2025, In 2025, the medicare tax rate is 1.45%. The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

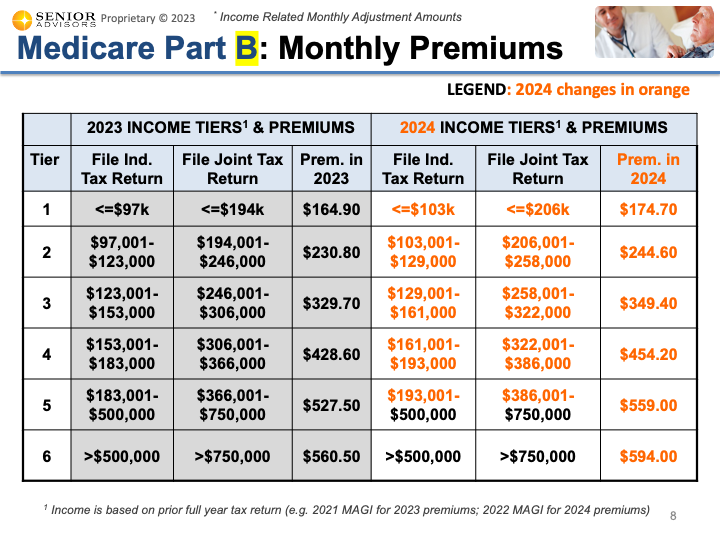

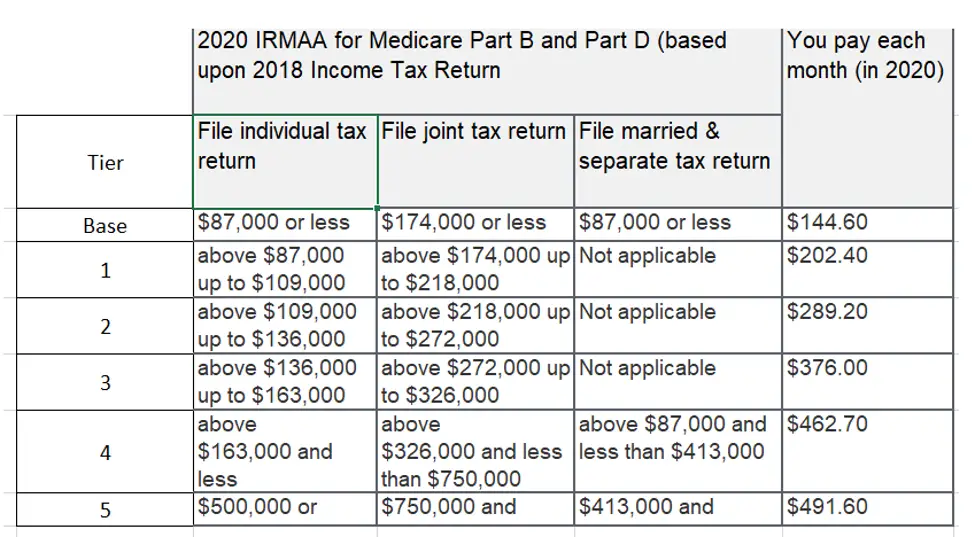

Irmaa 2025 Minni Quintina, For the 2025 tax year, those levels are: Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d.

2025 Tax Brackets Aarp Medicare Heda Rachel, For the 2025 tax year, those levels are: The budget proposes to increase the medicare tax rate on earned and unearned income.

What Are The Levels For Medicare Part B Premiums, But starting in 2025, they’ll have to pay 60% or 80%, depending on some rules. For 2025, the medicare surtax thresholds are set to impact single filers with an adjusted gross income (agi) above $200,000 and married couples filing jointly with an agi.

Medicare Tax Rate 2025 High Income. But starting in 2025, they’ll have to pay 60% or 80%, depending on some rules. It’s a mandatory payroll tax.

Let’s say a $75,000 annual salary might sound promising, after factoring in taxes (federal, state, social security, and medicare) at a conservative 35%, that number.

Tax Brackets 2025 Calculator Bevvy, But starting in 2025, they’ll have to pay 60% or 80%, depending on some rules. The tax increase from 3.8% to 5% on earned and unearned income above $400,000 is part of a package of proposals aimed at extending the solvency of.

Medicare Employee Tax Rate 2025 Lani Shanta, The current rate for medicare is 1.45% for the. The fee kicks in if you make more than.